It’s no secret most Republicans hate the Affordable Care Act.

Still, they’ve never been able to kill it. The reason is clear: It’s too politically popular. More than 6 in 10 Americans approve of it, according to polls, and that includes 62% of independents and almost a third of Republicans as of last year.

Consequently, Republicans in Congress are being pretty secretive about their plans this time.

Now, they’re trying to choke the ACA to death behind the curtains.

Previously little-known details of the GOP’s big tax cut bill, which is expected to come to a vote this week, make it clear that they’re planning major changes for Obamacare.

As an Axios writer put it earlier this week, “The Medicaid battle being waged by House Republicans is just the latest iteration of a long-running fight to repeal the Affordable Care Act, aka Obamacare.”

Remember the time Republicans tried this before?

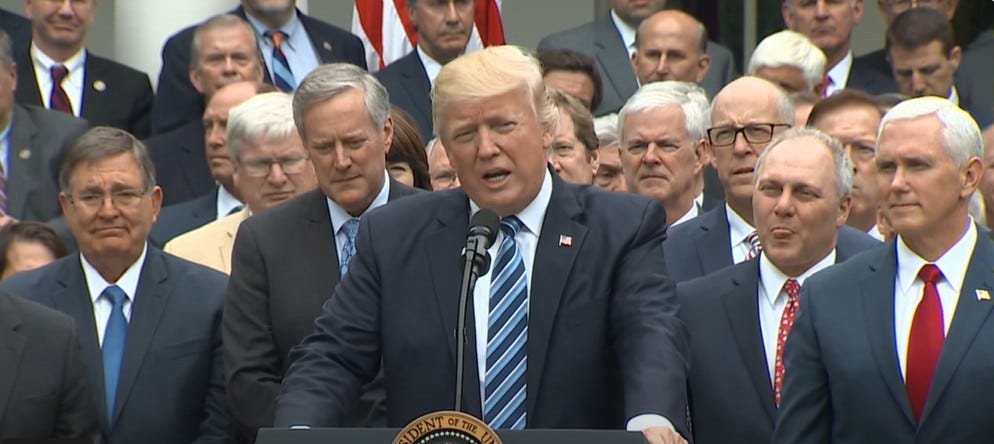

In Donald Trump’s first term, the GOP-controlled House passed a repeal bill. They had a huge celebration at the White House, and then ... the plan died. The Senate didn’t follow through, with a Republican being the one to stick a fork in it. (Remember John McCain’s thumbs down?)

This time, Republicans are trying to play it smart.

They’re not talking publicly about killing the Affordable Care Act. They’re talking about Medicaid work requirements and, like Mariannette Miller-Meeks, pretending that this is all a way to preserve health care spending for “the most vulnerable,” like the disabled.

As I explained last week, this is false. The disabled they claim to be defending will remain on yearslong waiting lists to get basic care, while Republicans use the Medicaid cuts to pay for extending and expanding tax cuts that mostly benefit the wealthy. One big provision in the bill gives more than 50% of the benefits to the top 1% of households.

Still, for all the attention that’s being paid to a flawed work requirement for Medicaid recipients, most of whom already are working, people who are covered by the Affordable Care Act also are being threatened by technical changes that will make it harder for them to re-enroll in a way that preserves the financial help that makes their health insurance affordable.

Drew Altman, the CEO at the Kaiser Family Foundation, wrote Tuesday the pending changes to the Affordable Care Act—including those in the Republican tax bill—could add up to reducing enrollment in the marketplaces by one third—or about 8 million people.

In Iowa, that translates into 45,000 people.

What’s so diabolical about the Republican changes is they aren’t just planning to let the enhanced premium tax credits approved during the Biden administration expire, but the tax cut language they’re poised to approve would also make complex revisions that are almost invisible to the general public.

For example, current law features an easy-to-use reenrollment feature that the GOP would dramatically alter.

As the blog at Georgetown University’s Center for Health Reforms reports:

“The legislation would prohibit passive reenrollment for financial assistance. Specifically, the legislation establishes a new system where the Marketplace must use information it obtains from enrollees after August 1 in order to verify their coverage for the coming year. If the enrollee has not provided information after that date, then there is no qualifying information that the Marketplace can use to determine eligibility.”

In Iowa, almost 54,000 Iowans use this feature, or 39% of the total. In fact, this kind of automatic reenrollment is similar to how reenrollment works for other types of health insurance, the center says. However, Republicans want to change it for the Affordable Care Act.

There are a number of other changes, too. The bill approved in the Energy and Commerce Committee, where Miller-Meeks is a member, would cut short the enrollment period, which coupled with the other changes, could lead to a lot of people losing coverage for an extended period of time.

Here’s the truth: Republican politicians hate Obamacare. They couldn’t get rid of it in daylight during Trump’s first term, so now they’re trying to choke it to death behind the scenes, using technical changes many people won’t notice until it’s too late. That could mean thousands of working Iowans will pay the consequences—and all to fund tax cuts for the rich.

Did I mention a new analysis by the respected Penn Wharton Budget Model?

According to USA Today, the model estimates the top 0.1% of households will gain nearly $390,000 on average next year from this legislation, while families earning between $17,000 and $51,000 a year will lose $700 when you include the Medicaid and food assistance cuts embedded in the legislation.

Not so big and beautiful, after all, is it?

Iowa salaries for teachers still rank low

Remember all the hullabaloo when Iowa Republicans passed a new law to raise teacher salaries last year? (The law also included much-criticized changes to Area Education Agencies.)

At the time, Republicans bragged the measure would put Iowa’s starting teacher pay in the top five nationwide.

This claim always seemed suspect to me. I once asked the governor’s office how she arrived at that ranking, but I never received a response.

Well, the new National Education Association’s annual survey of salaries across the country has come out, and Iowa is ranked 46th in the nation in average starting teacher pay for the 2023-2024 school year, according to a new Des Moines Register article.

To be clear, the teacher pay raises that Iowa lawmakers approved in 2024—their first in nearly a dozen years—isn’t included in this report. Still, the NEA says the average beginning teacher salary nationwide was $46,526 for the 2023-24 school year. In Iowa, it was $40,997.

The new Iowa law set minimum starting teacher pay this school year at $47,500, up from what it had been under state law, $33,500. In the 2025-26 school year, the minimum will rise to $50,000.

We’ll have to wait for new data to figure out how Iowa’s phased-in changes will position us relative to other states. I don’t know how Iowa will rank by then. Who knows, maybe other states won’t raise their salaries, and they’ll let us catch up. Either way, I suspect we won’t be in the top five. But look at it this way: Maybe we won’t be ranked 46th, either.

Along the Mississippi is a proud member of the Iowa Writers Collaborative. Please check out the work of my colleagues and consider subscribing. Also, the collaborative partners with the Iowa Capital Dispatch, which provides hard-hitting news along with selected commentary by members of the Iowa Writers Collaborative. Please consider making a donation to support its work, too.

Smoke, mirrors and lies work when people are not engaged or informed. America has an enormous deficit problem which should be resolved with more revenue and an honest approach about social security along with addressing a new approach to our defense budget. Taking the budget deficit out on those who can least afford it so you can give tax breaks to the wealthiest and corporations is not defensible. The wealthiest people do not have the goal of adding jobs nor do corporations so if there is another reason to hand them more money I want to hear about it.

Nice article Ed.

There are good provisions in Obamacare; no preexisting conditions and no lifetime maximum insurance company limits to name a few. That said, I'm pleased they've found and eliminated the provision paying former President Obama a royalty every year. Apparently, when Nancy Pelosi said, "Pass the bill then read it (paraphrased)" there was the hope that provision wouldn't see the light of day. Decent laws with some bad provisions always need modification in some manner.