Mariannette Miller-Meeks isn’t telling the truth.

As the House Energy and Commerce Committee took up a measure Tuesday cutting $715 billion in health care spending over 10 years, mostly to Medicaid, the Iowa Republican who sits on the panel claimed these cuts would preserve the program for “the most vulnerable.”

This isn’t true.

By now, most people know the Medicaid program that covers about 700,000 Iowans, including 10% of the state’s senior citizens, is being cut by Republicans to help pay for President Trump’s tax cuts. Even then, these tax cuts will add trillions of dollars to the federal debt.

Later in this article, I’ll explain how those Medicaid cuts help to pay for one particular tax break that’s heavily tilted toward millionaires, some of whom are cheating on their taxes. But first, let’s consider the false idea that these Medicaid cuts are geared toward preserving the program for “the most vulnerable.”

This claim has become an especially popular rightwing talking point, as Republican members of Congress try to explain why they are willing to take health care away from 8.6 million Americans while cutting taxes for the wealthy. One of the arguments is 700,000 disabled people are on Medicaid waiting lists while federal money is being spent on the “able-bodied” who don’t work.

In Iowa, we know about waiting lists. Thousands of people in this state are waiting for Medicaid waivers, one of the lengthiest wait lists in the country at nearly 22,000 as of last year, according to the Kaiser Family Foundation.

Some of these are duplicate applications, and Iowa is one of eight states that doesn’t screen those on its waiting lists, according to Kaiser. But it’s been clear for a long time that far too many poor and disabled Iowans have had to wait for years to get help with basic living needs, such as bathing and eating.

The important thing to remember here is this: These health care cuts aren’t going to be used to reduce those long Medicaid waiting lists. They aren’t going to help “the most vulnerable” get basic care. They’re being diverted to pay for tax cuts for the rich.

Now, let’s consider one of those “big, beautiful” tax cuts congressional Republicans, including Miller-Meeks, are poised to approve.

The 2017 Trump tax package included a 20% deduction for entities with “pass-through” income. These are businesses whose income is passed through to their owners who then report the proceeds to the IRS.

Despite assertions that this tax break is geared toward small businesses—and no doubt many small businesses claim this deduction—most of the benefits actually flow to the wealthy.

Over half of the proceeds in 2024 were going to households whose incomes are more than $1 million, according to the Center on Budget and Policy Priorities, citing figures from Congress’s non-partisan Joint Committee on Taxation.

Meanwhile, some of these entities, especially the really large ones, are failing to pay their fair share of taxes.

A National Bureau of Economic Research study, which included staff from the Internal Revenue Service, found “substantially underdetected tax evasion for pass-through businesses, including large partnerships,” according to a 2024 report by the Government Accountability Office.

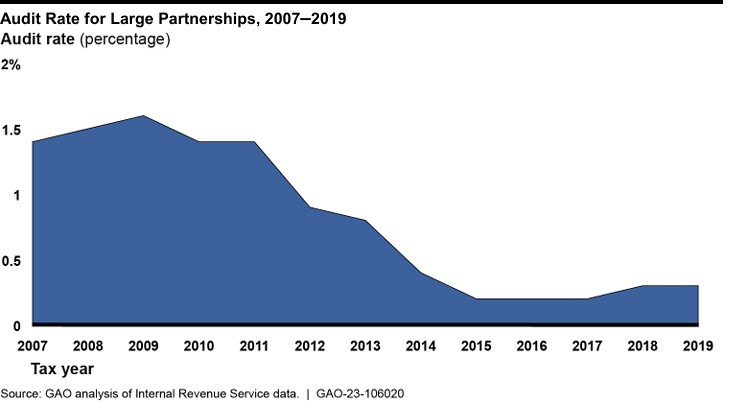

These large partnerships—meaning those with $100 million or more in assets or 100 or more partners—have grown by leaps and bounds since 2002, according to the GAO. But because of Republican cuts to the IRS budget, the agency hasn’t been able to audit very many of these complex entities.

In 2019, just 54 of 20,000 large partnerships were audited by the IRS, according to the GAO.

In other words, they don’t have to worry about getting caught cheating on their taxes, because hardly anybody is checking.

Yet, Republicans are planning to extend—and expand—this tax break. They are also working to gut IRS funding again so these wealthy businesses and partnerships can continue cheating on their taxes.

The cost of this big, beautiful tax break: $800 billion over 10 years, according to the Center on Budget and Policy Priorities, citing JCT figures.

Why not take some of this money and use it to help the hundreds of thousands of disabled people on Medicaid waiting lists? Why not refuse to give these tax breaks to large partnerships who are cheating on their taxes?

Republicans claim to care about “the most vulnerable.” But the truth is, their choices make clear they care more about expanding tax breaks going mostly to millionaires, some of whom already don’t pay their fair share of taxes. (One study a few years back said the richest 1% dodged taxes on more than a fifth of their income.)

Republicans want you to believe Medicaid recipients are the ones ripping off the American taxpayer. But nearly two-thirds of working-age Medicaid recipients are already working, according to the Kaiser Family Foundation, and many of those who aren’t have other obstacles to employment, like caregiving responsibilities.

Are there some “able-bodied” Medicaid recipients who should be working but aren’t? I’m sure there are. But government has also shown it’s pretty lousy at finding them. Past experience demonstrates that work requirements don’t work, and in some cases are counterproductive.

Meanwhile, the lengths that Republicans go to in order to catch these folks, including more frequent certification, has resulted in kicking people off Medicaid who are, in fact, eligible for coverage.

In other words, they may do more harm than good.

Designing tax and spending policies is about competence, but it’s also about making choices. Congressional Republicans like Mariannette Miller-Meeks have made their choice. They want Trump’s tax cuts, but to get them through Congress, they have to cut Medicaid, too.

They are trying to sell the idea these Medicaid cuts are necessary to help the most vulnerable. But they’re not. Instead, millions of people will lose heath care coverage, while hundreds of billions of dollars will go toward extending and expanding tax cuts for the wealthy—including businesses and large partnerships that already are dodging their taxes.

That’s an awful choice.

Along the Mississippi is a proud member of the Iowa Writers Collaborative. Please check out the work of my colleagues and consider subscribing. Also, the collaborative partners with the Iowa Capital Dispatch, which provides hard-hitting news along with selected commentary by members of the Iowa Writers Collaborative. Please consider making a donation to support its work, too.

Great idea, keep giving tax-cuts to the wealthy, while more folks join the POVERTY RANKS. For the past 45 years the GOP have sucked the life out of the Middle-class. How about we raise the minimum wage to $20.00 per hour, healthcare to everyone, and you pay into Social Security until you make over $10 million a year. The REDISTRIBUTION OF WEALTH TO THE TOP 2% must end very soon. Consumer spending drives 70% of the economy, when the consumer is BROKE, there will no longer be a strong GDP----ONLY POVERTY AND MANY MORE FOOD BANKS. AMERICA HAS SHOWN THAT WE MUST ONLY TAKE CARE OF THE WEALTHY---NO ONE ELSE MATTERS.

I agree there should be more funding and scrutiny for Medicaid. That said, I have no issue with pass-through tax incentives to those who own small and mid-sized businesses. They take the risk, receive little in the way of contracts and incentives that large corporations receive, and employ the greatest number of workers in this country. Continue the incentive to get wealthier and they'll continue to invest. Stop the incentive and you've effectively stopped the investment and employment growth.

I hope they pass the Big Beautiful Bill and have no sunset provisions.