New mailings zero in on Miller-Meeks for tax break that benefits 'rich coastal elites'

Also, Chuck Grassley is frustrated

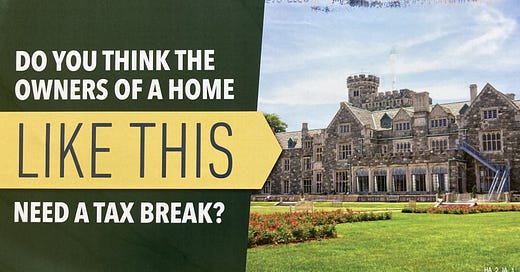

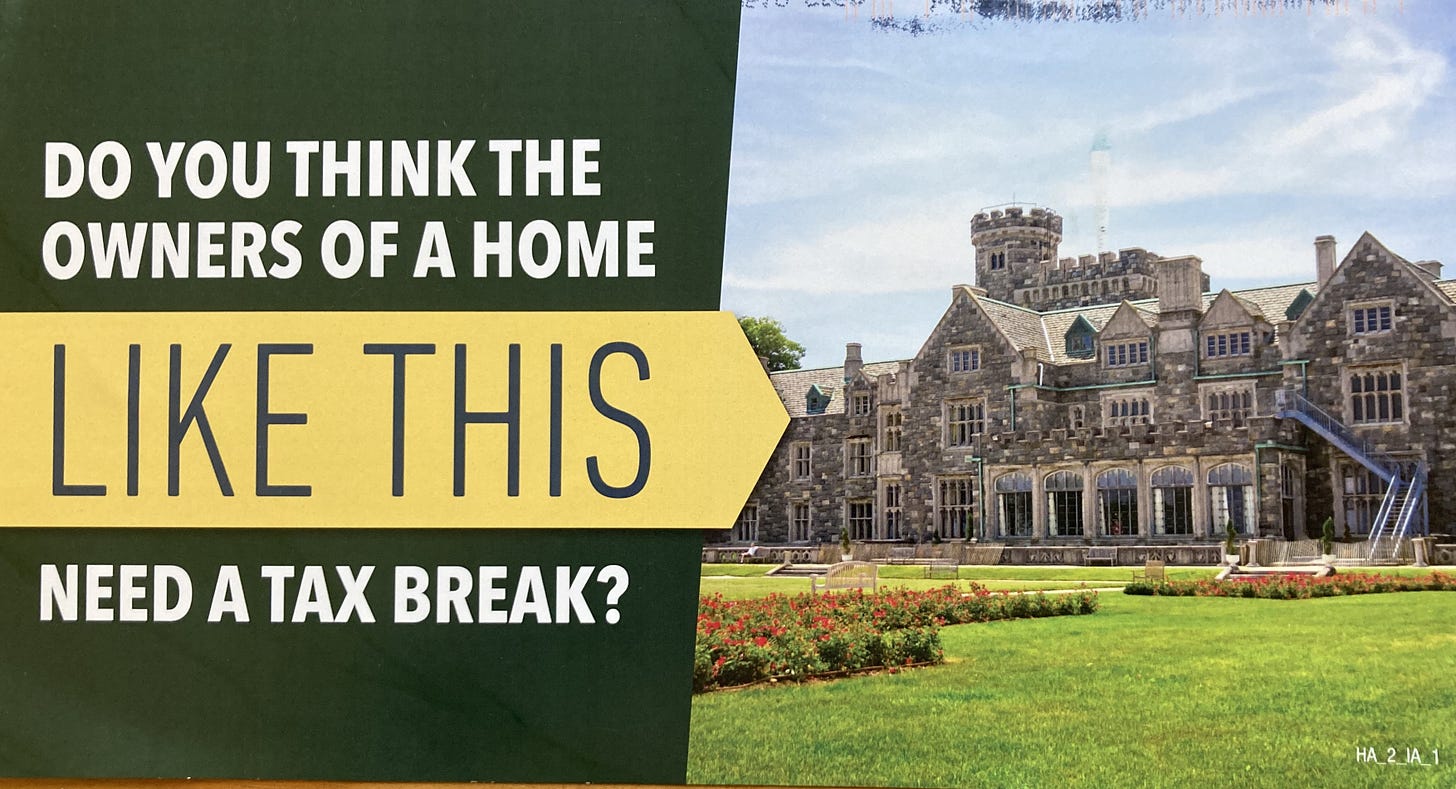

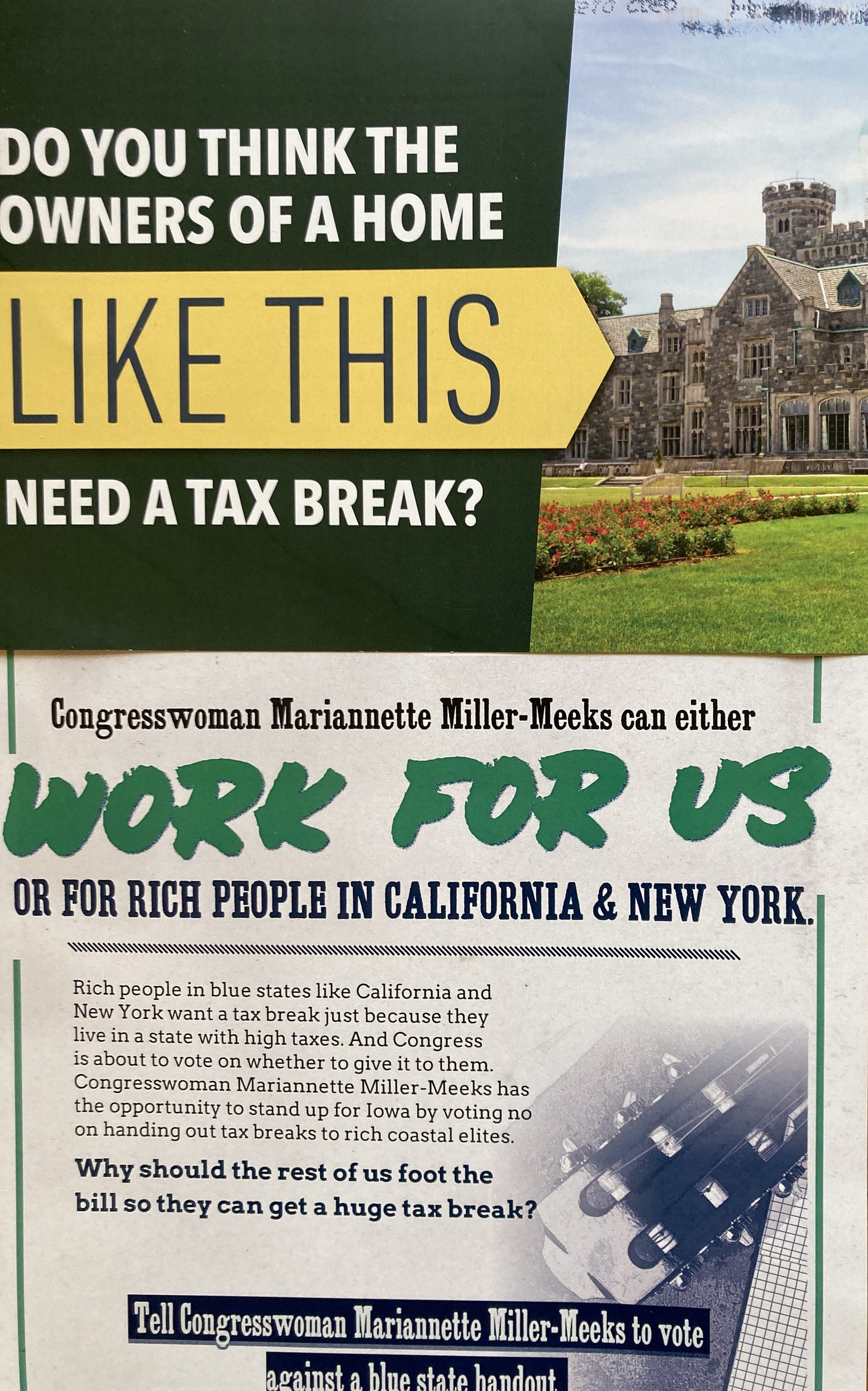

A tax break that will benefit wealthier Americans, mostly in states run by Democrats, is being used to put political pressure on US Rep. Mariannette Miller-Meeks. The Iowa Republican is expected to be one of the most vulnerable incumbents in next year’s congressional midterms.

I received two mailings in Davenport recently that focused on Miller-Meeks for the tax break, which was included in the Trump tax cut proposal the House passed by a single vote last week.

There’s a certain irony to this.

When congressional Democrats pushed for the same tax break during Joe Biden’s presidency, Republicans ripped them for it. Sen. Joni Ernst said it was aimed at helping wealthy “coastal elites.”

Now, the tables are turned.

The mailers I received used the same words.

“Rich coastal elites don’t need another handout,” one of the mail pieces reads.

I don’t know who is funding the mail piece. Republicans and Democrats have criticized the tax break. The mailers say they are “paid for by Hardworking America.” The postmark is from Newark, New Jersey.

At issue is the federal deduction for State and Local Taxes, or SALT. The 2017 Trump tax cut legislation capped the SALT deduction at $10,000, which upset politicians in states like New York, New Jersey and California that have relatively high property and state income taxes.

However, last year, while trying to help Republicans running for Congress in New York, Trump reversed course and vowed to restore the tax break. That, of course, silenced most of the Republican critics who dared not differ with Trump. And now, after lengthy negotiations, the House-passed measure proposes raising the cap on the deduction to $40,000 for taxpayers with earnings up to $500,000. Miller-Meeks voted for the bill.

This is a big windfall to people who live in these higher-tax states.

For states like Iowa, it does relatively little.

Only 7% of tax filers in Scott County (where Davenport is located) used the deduction in 2022, according to the Tax Policy Center, a joint initiative of the Urban Institute and the Brookings Institution.

In other counties in Iowa, the story was much the same. But the so-called rich coastal elites did a whole lot better.

In Suffolk County, New York, 19% used the deduction. In San Francisco County, California, 17% did.

Meanwhile, the actual dollars from the tax break’s proceeds are bound to flow overwhelmingly to the rich.

The Tax Foundation said in a post last week that with a $40,000 cap (and a phase out threshold of $500,000), the bottom 80% of taxpayers would get no benefit at all, while the biggest boost would go to the top 5%.

In the meantime, this tax break would cost the US treasury $320 billion over 10 years compared with simply extending the existing cap.

This could add up to political poison for lawmakers on the bubble in states like Iowa, where the same Trump tax bill also proposes to cut Medicaid and food assistance that will hit working households hard. The respected Penn Wharton Budget Model says households making between $17,000 and $51,000 a year will lose $700 when the health care and food assistance cuts from the legislation are factored in.

That’s quite a contrast from the gift being given to the recipients of the enhanced SALT provision.

“Why should the rest of us foot the bill so they can get a huge tax break,” one of the mail pieces asks?

This, undoubtedly, is a question Miller-Meeks will have to answer.

Iowa’s watchdog, Chuck Grassley

In the face of Donald Trump, congressional Republicans have proved themselves to be especially wimpy.

Still, there may be signs of a spine. At least that’s what a Washington Post story suggested last week.

Congressional Republicans said nothing when Trump pardoned hundreds of people who took part in the attack on the US Capitol on Jan. 6.

They looked away when he fired more than a dozen inspectors general.

Even the luxury jet Qatar is giving to Trump was met with a shrug.

However, the Post told us in a story Friday there may be hope.

It wasn’t just Sen. Tom Tillis’s opposition to Ed Martin as US attorney for Washington, D.C., that deep-sixed his nomination. There were other Republicans on the Judiciary Committee who were not happy, either. Iowa’s Chuck Grassley was one of them, the story said.

The longtime senator and chair of the Judiciary Committee didn’t publicly oppose Martin who used his office to threaten Trump’s political enemies, praised a man federal prosecutors called a Nazi sympathizer and was accused by national security analysts of echoing Russia’s anti-American rhetoric.

However, the Post said, Republicans on the committee were not happy given revelations about Martin’s appearances on far-right news outlets and podcast recordings that weren’t disclosed to the committee. As the Post put it, even Grassley was … “frustrated.”

It’s good to know that Grassley is back on the job.

Joni Ernst goes after some ‘free-loading fat cats,’ but not others

You’ve got to wonder if Joni Ernst will ever cut any wasteful spending in Washington, D.C.

Last week, Iowa’s favorite fake fiscal conservative bragged that she was going to stop millionaires from getting unemployment benefits. Ernst complained that more than 20,000 millionaires got jobless benefits in 2021 and 2022 “during the first two years of the Biden administration.”

Then, she boasted about a new bill she introduced that “ends these freebies for free-loading fat cats”

We’ve seen scam this before.

Ernst introduced the same proposal in 2022, and it went nowhere.

No surprise. Ernst has a habit of conning media outlets into falling for her deceptive claims, such as the phony assertion that only 6% of the federal workforce reported to work in person.

The schtick goes like this: Ernst will cite selectively gathered data designed to cause outrage, and then she’ll announce a not-so-cleverly named bill she claims will eliminate the problem.

Inevitably, nothing happens.

In this case, the Congressional Research Service said Ernst asked it to tell her how many millionaires and billionaires got jobless benefits in 2021 and 2022.

I don’t know why Ernst didn’t ask for 2020 data. Maybe it’s because Donald Trump was president then, and more than 19,000 millionaires got jobless benefits, according to Politico.

On an annual basis, that means about twice as many “free-loading fat cats” were awarded jobless benefits under Trump than under Biden during the years in question. (The truth is this, much of this was due to enhanced Covid benefits—which Ernst voted for—as well as a 60-year-old federal rule prohibiting means testing in the unemployment insurance program.)

You would think by now that Iowans—and news organizations—would catch on to this con. Ernst isn’t even the first Republican who’s failed to stop millionaires from getting unemployment benefits. Sen. Tom Coburn of Oklahoma tried it in 2011, but he only got three co-sponsors for his bill.

Regardless, the fat cats can rest easy.

Even if, by some miracle, Ernst’s bill passes, she’ll make up for it by voting for Trump’s new tax cut, which according to the Penn Wharton Budget Model, will bestow an average of nearly $390,000 on each of the US households in the top 0.1%. Talk about fattened cats.

The Trump tax plan also will drop a “debt bomb” on our kids and grandkids, who will spend their lives trying to pay it off, according to budget experts.

The fact is millionaires and billionaires—working or otherwise—have nothing to fear from Joni Ernst. But future generations are going to get crushed.

Correction: The original version of this post erroneously suggested Joni Ernst was in the US Senate in 2011. The reference has been removed.

Along the Mississippi is a proud member of the Iowa Writers Collaborative. Please check out the work of my colleagues and consider subscribing. Also, the collaborative partners with the Iowa Capital Dispatch, which provides hard-hitting news along with selected commentary by members of the Iowa Writers Collaborative. Please consider making a donation to support its work, too.

If I were running against any of these Iowa Republicans, I would absolutely campaign against their vote to give people tax breaks on their mansions.

Was the group that paid for the mailer Hardworking America? Not Hardworking Americans?

https://www.hardworkingamericans.org/

Thanks for this report, Ed.