If you’re like me, you breathed a sigh of relief last week. The April 15 federal tax deadline came and went, and my family filed on time.

Obviously, we weren’t alone.

In the final weeks leading up to the deadline, 10 million to 15 million Americans file their taxes each week.

That’s a lot of returns to process. So, it’s probably not a good sign that the Internal Revenue Service could lose about a third of its staff this year. The New York Times reported last week that 22,000 IRS workers have signed up for the Trump administration’s latest offer to cut the federal workforce.

Combined with earlier resignations and layoffs, which still are being challenged in the courts, that means we’ll go back to the bad old days of an understaffed IRS. Which means slower processing of tax forms, fewer audits, declining customer service and, perhaps worst of all, more cheating.

For those of us who take our obligations seriously and don’t try to dodge our responsibility, this is not good news.

Former Treasury Secretary Larry Summers said the Trump administration’s actions could mean $1 trillion in less revenue over the next decade.

If you care about the federal deficit or tax equity, this is very bad news. Already, the tax gap, which is the annual difference between the taxes owed and those paid on time, was $700 billion in 2022.

This will not surprise you, but it’s not the poor and middle class who are doing most of the cheating. The federal government estimates the top 1% account for $160 billion of the tax gap.

I realize some right-wingers will applaud a neutered IRS.

Already, Sen. Joni Ernst of Iowa has called for less scrutiny of wealthy taxpayers. In a letter to the Trump administration last month, Ernst proposed eliminating effective audits for passthrough entities, also known as partnerships.

This would be a boon for the wealthy.

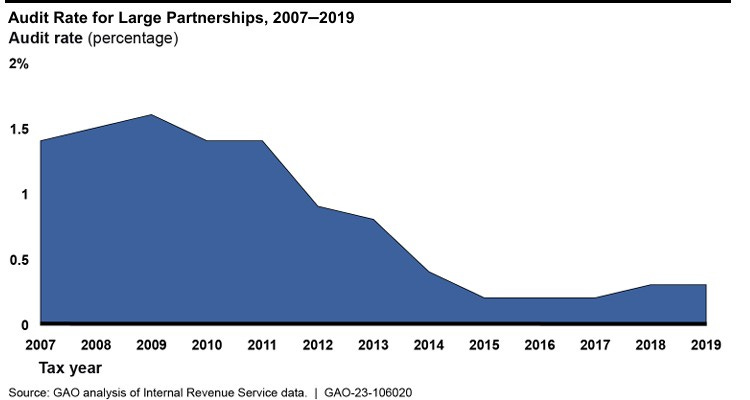

A Government Accountability Office report in 2023 said large partnerships—defined as having $100 million or more in assets and 100 or more partners—have exploded in number since 2002, even as audits of these entities have sharply declined, especially beginning in 2011. Which is about the same time the Republican-controlled Congress began dramatically cutting the IRS’s budget.

In 2019, there were 20,000 large partnerships, but only 54 were audited, the report said.

Even the audits that were done apparently weren’t up to snuff.

Another GAO report cited a study that said audits “substantially underdetected tax evasion for pass-through businesses, such as partnerships.” The study said “a more specialized approach” is needed to detect noncompliance. Which is what the Biden administration was moving toward.

Yet, Joni Ernst wants to kill this effort. And she’ll probably get her wish. Which means the tax gap will probably grow and the rest of us will have to pick up a bigger share of the tab for the rich tax cheats.

Not only are right-wingers preparing to gut the IRS’s auditing capability, but they also apparently want to push Americans even further into the arms of the tax preparation industry.

The Associated Press has reported the Trump administration is preparing to end the Direct File program, an initiative launched by the Biden administration for people to file their taxes for free directly to the IRS.

The tax preparation industry hates the program, and the AP article suggests there are some issues with it. But the Tax Policy Center said recently it found in December that 75% of non-elderly tax filers surveyed expressed an interest in the program. No wonder. As the center said, “unlike other products marketed as free, Direct File customers are not presented with costly upgrades throughout the filing process.”

This sounds like a way to save taxpayers money. In fact, one study said the program, at maturity, would save the average taxpayer $160 in tax preparation fees and hours of their time. The AP says that there was some hope, apparently within the IRS, that DOGE might help the program. Instead, it appears the administration is moving to kill it. Which is too bad for those of us who do our own taxes and want an easier way to file free from being inundated with sales pitches.

As I said earlier, I’m glad the tax deadline has passed. The first couple weeks of April are hectic in my household. Still, my family considers it our civic duty to do our share. And we count on our government to make sure others do, too. Unfortunately, the way things are going, it looks like the IRS will again be hamstrung by a Congress and White House that don’t mind helping the rich dodge their taxes, even if this means it will be more expensive for the rest of us.

Join us in the Office Lounge

This Friday at noon, the Iowa Writers’ Collaborative will host its monthly Office Lounge meeting. This is the session where paying subscribers can join the members of the Collaborative via Zoom to hear from the writers and offer suggestions and ask questions.

Here is the link for our paying subscribers. Thanks again for your support.

Along the Mississippi is a proud member of the Iowa Writers Collaborative. Please check out the work of my colleagues and consider subscribing. Also, the collaborative partners with the Iowa Capital Dispatch, which provides hard-hitting news along with selected commentary by members of the Iowa Writers Collaborative. Please consider making a donation to support its work, too.

Ed you are spot on about the most wealthy for the most part hate paying taxes and dislike the IRS. They are quick to point out they pay more than 50 percent of all of taxes collected and an incredible number of citizens pay nothing. The IRS is at incredible disadvantage in collecting taxes on the ultra wealthy who get tax avoidance advice along with legal advice that is no match for the IRS.

Trump’s tax returns are a perfect example. What you didn’t mention was that corporations have entire Departments dedicated to tax avoidance and clearly are not paying their fair share. I favor corporate minimum taxes depending on revenue and a flat tax rate for individuals and just disregard the whole complicated tax code. With both of these moves you don’t need more IRS employees.

Thank you for raising this issue!